Sei Investments Co. grew its position in Potlatchdeltic Corp (NASDAQ:PCH) by 39.9% during the 1st quarter, HoldingsChannel reports. The firm owned 68,663 shares of the real estate investment trust’s stock after acquiring an additional 19,589 shares during the quarter. Sei Investments Co.’s holdings in Potlatchdeltic were worth $3,574,000 at the end of the most recent quarter.

Sei Investments Co. grew its position in Potlatchdeltic Corp (NASDAQ:PCH) by 39.9% during the 1st quarter, HoldingsChannel reports. The firm owned 68,663 shares of the real estate investment trust’s stock after acquiring an additional 19,589 shares during the quarter. Sei Investments Co.’s holdings in Potlatchdeltic were worth $3,574,000 at the end of the most recent quarter.

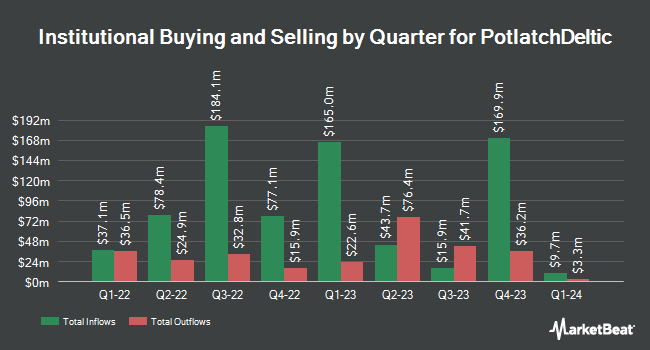

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Csenge Advisory Group acquired a new position in shares of Potlatchdeltic in the 1st quarter valued at about $200,000. Zeke Capital Advisors LLC acquired a new position in Potlatchdeltic during the 1st quarter worth approximately $205,000. Xact Kapitalforvaltning AB acquired a new position in Potlatchdeltic during the 4th quarter worth approximately $206,000. Zurcher Kantonalbank Zurich Cantonalbank lifted its position in Potlatchdeltic by 124.9% during the 1st quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 4,023 shares of the real estate investment trust’s stock worth $209,000 after acquiring an additional 2,234 shares in the last quarter. Finally, Financial Engines Advisors L.L.C. lifted its position in Potlatchdeltic by 168.6% during the 1st quarter. Financial Engines Advisors L.L.C. now owns 4,556 shares of the real estate investment trust’s stock worth $237,000 after acquiring an additional 2,860 shares in the last quarter. 82.13% of the stock is currently owned by institutional investors and hedge funds.

Get Potlatchdeltic alerts:

PCH stock opened at $50.55 on Tuesday. The company has a current ratio of 2.64, a quick ratio of 1.87 and a debt-to-equity ratio of 0.59. Potlatchdeltic Corp has a 52-week low of $43.85 and a 52-week high of $56.35. The company has a market cap of $3.14 billion, a price-to-earnings ratio of 18.47, a price-to-earnings-growth ratio of 4.17 and a beta of 1.31.

Potlatchdeltic (NASDAQ:PCH) last posted its quarterly earnings data on Thursday, May 3rd. The real estate investment trust reported $0.69 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.61 by $0.08. Potlatchdeltic had a return on equity of 24.94% and a net margin of 11.54%. The company had revenue of $199.90 million for the quarter, compared to the consensus estimate of $168.68 million. equities analysts forecast that Potlatchdeltic Corp will post 2.4 EPS for the current fiscal year.

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, June 29th. Shareholders of record on Thursday, June 7th will be issued a dividend of $0.40 per share. The ex-dividend date is Wednesday, June 6th. This represents a $1.60 annualized dividend and a yield of 3.17%. Potlatchdeltic’s dividend payout ratio is presently 67.80%.

Several research firms recently commented on PCH. Zacks Investment Research lowered Potlatchdeltic from a “buy” rating to a “sell” rating in a research report on Tuesday, May 1st. Vertical Research raised Potlatchdeltic to a “hold” rating in a research report on Monday, May 7th. They noted that the move was a valuation call. BidaskClub raised Potlatchdeltic from a “sell” rating to a “hold” rating in a research report on Tuesday, May 22nd. Royal Bank of Canada raised Potlatchdeltic from a “sector perform” rating to an “outperform” rating and set a $47.00 price target on the stock in a research report on Monday, May 7th. Finally, DA Davidson raised Potlatchdeltic from an “underperform” rating to a “neutral” rating and set a $44.00 price target on the stock in a research report on Monday, May 7th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and three have given a buy rating to the company. The stock currently has a consensus rating of “Hold” and an average price target of $50.67.

Potlatchdeltic Company Profile

PotlatchDeltic Corporation (NASDAQ:PCH) is a leading Real Estate Investment Trust (REIT) that owns nearly 2 million acres of timberlands in Alabama, Arkansas, Idaho, Louisiana, Minnesota and Mississippi. Through its taxable REIT subsidiary, the company also operates six sawmills, an industrial-grade plywood mill, a medium density fiberboard plant, a residential and commercial real estate development business and a rural timberland land sales program.

Want to see what other hedge funds are holding PCH? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Potlatchdeltic Corp (NASDAQ:PCH).

Sei Investments Co. grew its position in Potlatchdeltic Corp (NASDAQ:PCH) by 39.9% during the 1st quarter, HoldingsChannel reports. The firm owned 68,663 shares of the real estate investment trust’s stock after acquiring an additional 19,589 shares during the quarter. Sei Investments Co.’s holdings in Potlatchdeltic were worth $3,574,000 at the end of the most recent quarter.

Sei Investments Co. grew its position in Potlatchdeltic Corp (NASDAQ:PCH) by 39.9% during the 1st quarter, HoldingsChannel reports. The firm owned 68,663 shares of the real estate investment trust’s stock after acquiring an additional 19,589 shares during the quarter. Sei Investments Co.’s holdings in Potlatchdeltic were worth $3,574,000 at the end of the most recent quarter.